Employees Responsibilities 31. You wouldnt want to include any income that is entitled to tax exemptions on your form either.

List Of Tax Deduction For Businesses Cheng Co Group

Self and dependent relatives.

. Import Duty and Sales Tax Exemption on KN95 Type Face Mask. Other Benefits 14 8. Life insurance and EPF including not through salary deduction.

SERVICE TAX AMENDMENTS 2019. Tax Exemption on Benefits in Kind Received by an Employee 14 9. On the first 5000.

Corporate tax highlights. 4 Order 2019 was gazetted which grants an income tax exemption for certain payments by Malaysian resident individuals to nonresidents relating to software or site licenses. Relevant Provisions of the Law 1 3.

Types Of Perquisites And The Tax Treatment 7 7. 4 Order 2019 was gazetted which grants an income tax exemption for certain payments by Malaysian resident individuals to nonresidents relating to software or site licenses. Employers Responsibilities 30 9.

A The exemption is applicable for service tax registered person in Group G who. Here are the income tax rates for personal income tax in Malaysia for YA 2019. Chargeable Income RM Calculations RM Rate Tax RM 0 5000.

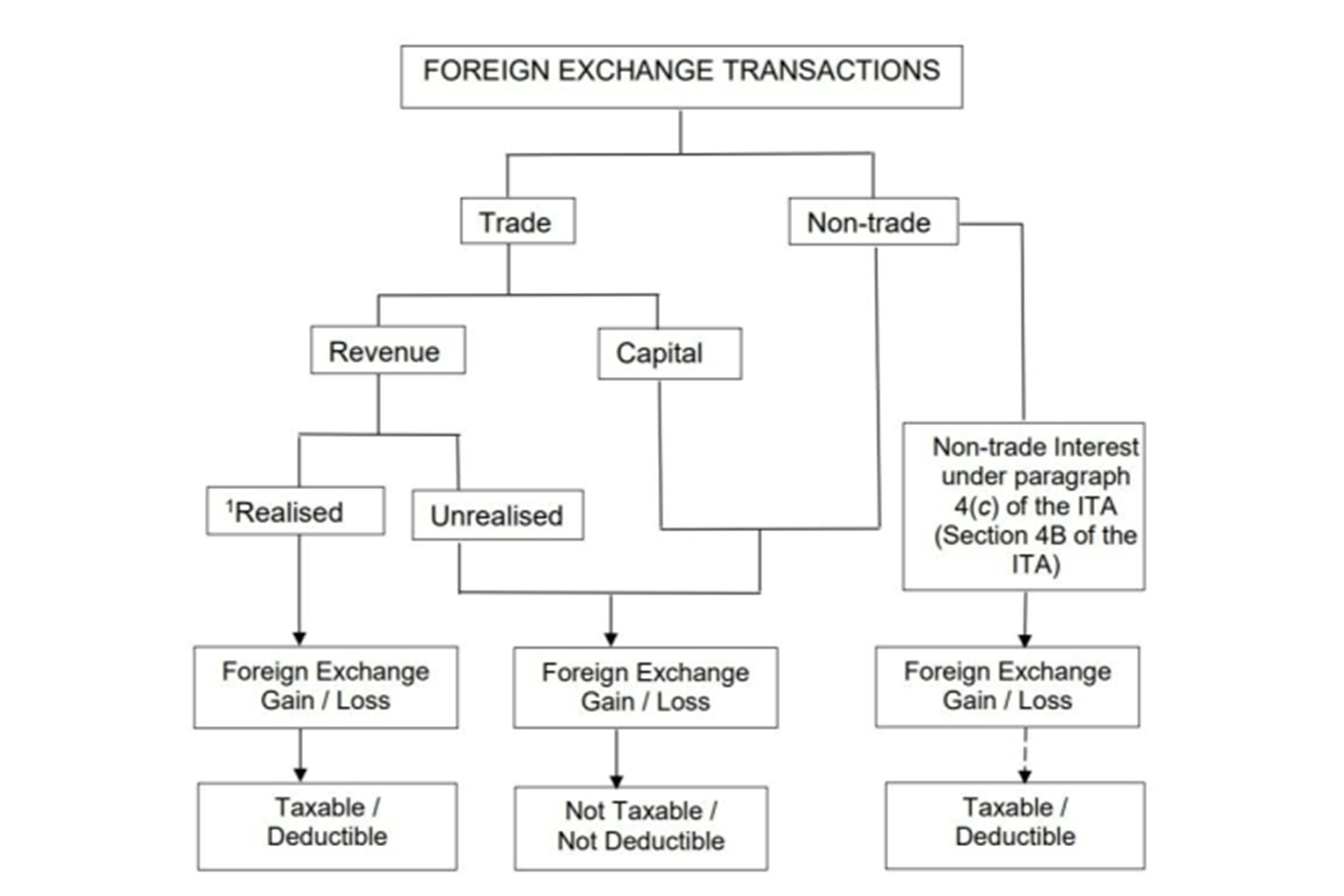

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company. 12 December 2019 CONTENTS Page 1. Ascertainment of the Value of Benefits in Kind 3 6.

The order is deemed to have come into operation on 1 March 2019 and is effective retroactively as from this date. These are the types of personal reliefs you can claim for the Year of Assessment 2021. Up to RM7000 life insurance.

Tax Exemption On Perquisites Received By An Employee 18 8. The order is deemed to have come into operation on 1 March 2019 and is effective retroactively as from this date. 19 November 2019 attitude she often receives tips from customers who patronise the.

Benefits in Kind 2 5. For pensionable public servants. Objective The objective of this Public Ruling PR is to explain -.

For example perquisites which cover things like parking medical and. This exemption will be applicable to any company in Malaysia who acquires taxable services of Group G item a. Insurance other policies.

The existing tax exemption for interest earned on wholesale money market funds will cease with effect from 1 January 2019. Particulars of Benefits in Kind 4 7. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and below.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2. 52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. On 28 May 2019 the Income Tax Exemption No.

More 65. A Limited Liability Partnership LLP resident in Malaysia with. 25062019 Guide on Sales Tax Exemption Under Schedule A for Item 33a33b556364 65 More 111.

102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Highlights in Budget 2019 Tax Espresso Special Edition Corporate Tax Review of corporate income tax rate for small and medium enterprise SME It is proposed that the income tax rate on first RM500000 of chargeable income of SME be reduced from 18 to 17. 24 Order 2002 PUA 2102002.

2019 Tax Espresso Special Edition 5 Extension of tax incentive for issuance of-i sukuk. A resident company incorporated in Malaysia with an ordinary. On 28 May 2019 the Income Tax Exemption No.

Income Tax Exemption No. 10 December 2019 Page 1 of 42 1. EXEMPTION FROM PAYMENT OF SERVICE TAX UNDER THE SERVICE TAX PERSONS EXEMPTED FROM PAYMENT OF TAX ORDER 2018.

With effect from 1 January 2019 this tax exemption will cease. Interpretation The words used in this PR have the following meaning.

Individual Income Tax In Malaysia For Expatriates

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Lhdn Irb Personal Income Tax Relief 2020

Here S How To Maximise Your Education Income Tax Relief

St Partners Plt Chartered Accountants Malaysia Customs Latest Release 31 10 2019 Guide On Sales Tax Exemption Under Schedule A For Item 57 This Guide Is Provided To Assist Business

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Lhdn Irb Personal Income Tax Relief 2020

Five Public Rulings Updated And One New Public Ruling Issued By The Inland Revenue Board Ey Malaysia

Taxplanning So You Want To Start Your Own Business The Edge Markets

Malaysia Sst Sales And Service Tax A Complete Guide

Solar Tax Incentive Yongyang Solaroof Solar Energy Roofing Malaysia

Goods And Person Exempted From Sales Tax Sst Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

2019 Personal Income Tax Deduction Category Asq

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Director Medical Fees Tax Deductible Malaysia

Income Tax Malaysia 2018 Mypf My